This new Federal national mortgage association Household Roadway financing program enjoys a good reputation which have first time home buyers and you may realtors. Federal national mortgage association works closely with home mortgage organizations or any other stakeholders from the real estate and you will financing marketplaces to aid people just who provides Fannie mae funds to get rid of a foreclosure.

Yet not, there are a few times when a property foreclosure try inescapable. Whenever a foreclosures occurs, the purpose of Federal national mortgage association is to sell the house due to the fact rapidly you could to some other owner. The brand new HomePath financing have helped striving home owners and provides the latest possibilities for new home customers.

Very first time Home Buyers across the country Is actually Embracing Fannie Mae funds much more about because of their Dedication to Domestic-Ownership into Home Road Mortgage Program.

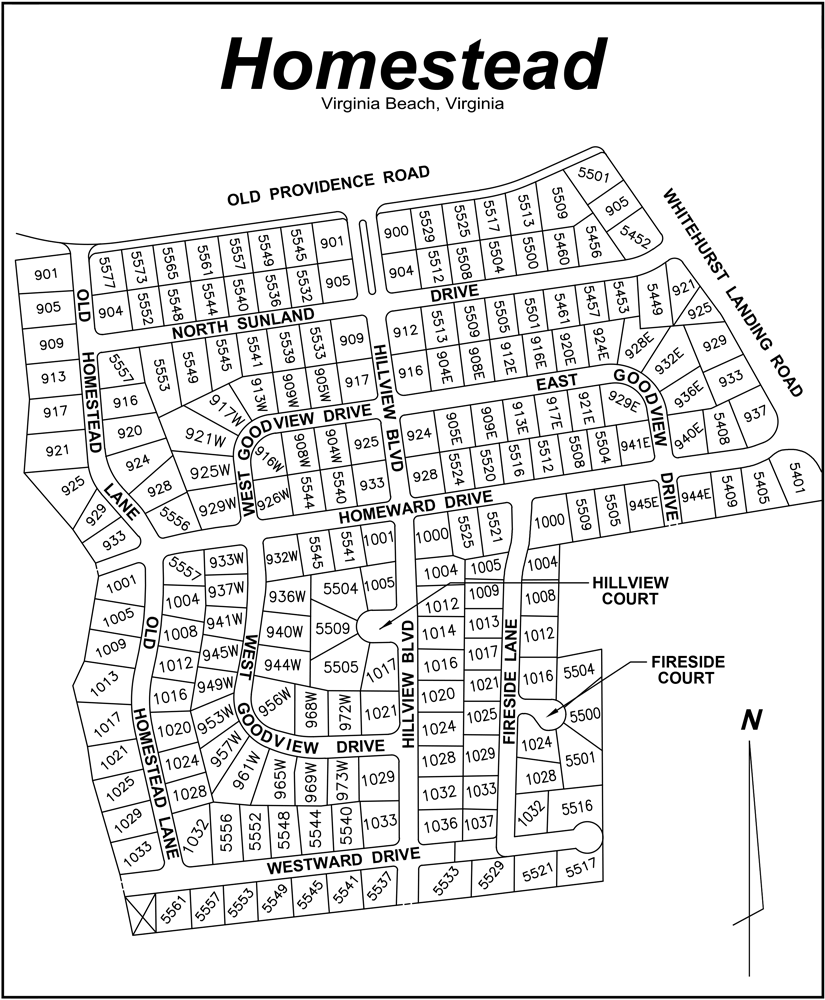

Brand new downside of HomePath loan program is the index. A few of the features may not be in your community you are looking for and you may not pick of a lot home into the other areas where you have to live. The procedure might take time for you pick an eligible assets. You may need to continue to watch the fresh new Federal national mortgage association HomePath website to find out if a property comes up into the a place for which you want to buy. The newest Fannie mae HomePath mortgage brokers are creating another opportunity having first-time home buyers along the United states.

For some earliest-go out homeowners, navigating the fresh complex land away from mortgages would be a frightening task. Most of the time, traditional lending applications come with rigorous borrowing from the bank requirements which make it problematic for a lot of is accepted to own sensible financial support. However, the fresh new Federal national mortgage association HomePath mortgage, an alternative program intended to clear up our home purchasing processes. Delight understand that Federal national mortgage association bucks-aside re-finance choices are .

The fresh HomePath mortgage are a funds solution backed by Federal national mortgage association, among the many government-sponsored people (GSEs) tasked which have supporting the construction should be to assists the income of Fannie mae-owned properties, that can easily be foreclosed home gotten through the foreclosures techniques.

Federal national mortgage association desires ensure that the possessions is empty getting as little big date that one can. Bare house in organizations impact the property viewpoints away from other family residents. And this refers to where Fannie mae HomePath loan system will come towards play.

The attributes which can be backed by Fannie mae try listed on the brand new HomePath site. Each list is sold with photographs and you will a complete malfunction of the property.

HomePath money allows for each and every guest to choose possessions details, such price or level of bed rooms to discover the best assets due to their demands.

When it comes to this unique Federal national mortgage association mortgage, make sure you are conversing with licensed HomePath lenders that have expertise in the merchandise.

The latest HomePath web site enjoys many types of belongings in every brands off communities along side All of us. You’ll find unmarried household members home, townhouses and you will condominiums.

Federal national mortgage association Interested in The newest Property owners

Fannie mae loves to promote the HomePath services only to buyers exactly who propose to inhabit the house. It generally does not want to promote this new features to investors who happen to be browsing both lease otherwise promote the house. In the event the residence is basic detailed, Federal national mortgage association accepts offers away from simply proprietor residents to have 15 days. This allows these property is quote through to in the payday loan Allgood AL place of prices becoming driven up by the people. This new countdown that is left are showed for the assets list on the internet site.

This type of homes are extremely competitively listed. That is why if you’re looking getting a primary-date domestic client program that have versatile borrowing from the bank, it’s also possible to take into account the Federal national mortgage association HomePath loan program. In addition, it is a good choice for people who find themselves looking having a reasonable, huge household, and retirees who would like to off dimensions to the a small funds.