Having increasing dumps, slow wage growth and you can high assets rates, it’s no wonder a large number of millennials turn to their moms and dads to have assist – although not everybody is able to offer a lump sum to the in initial deposit.

In the event you can not, bringing a mutual mortgageor acting as an effective guarantor is definitely a consideration. However, latest income tax reforms are making these types of options less attractive to possess mothers.

These day there are signs, however, you to very-titled ‘joint borrower just proprietor’ (JBSP) mortgages are getting common, which have brokers revealing a life threatening increase in enquiries recently.

Right here, i check out this specific niche equipment and you may whether or not it would-be an important option for mothers who would like to help their pupils get on into the assets ladder.

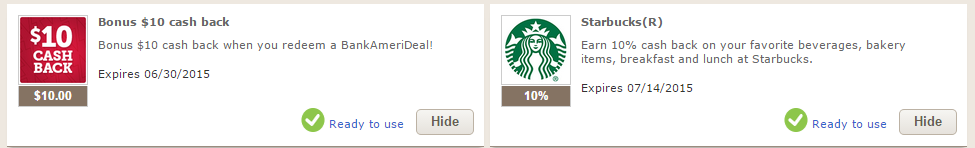

Be more money savvy

This publication brings totally free currency-associated content, along with other details about And therefore? Class products. Unsubscribe at any time. Your computer data will be canned according to our Online privacy policy

What’s good JBSP financial?

A shared debtor just holder mortgage lets a grandfather to aid the youngster pick property from the joining the mortgage. But as opposed to a fundamental shared home loan , brand new parent is not called on the title deeds.

Before, these contract were slightly market, primarily employed by parents have been concerned about being required to spend money progress taxation if the property are ended up selling.

not, reforms to stamp obligations have generated this sort of price all the more attractive, which have you to definitely broker stating enquiries now are available with the an everyday – unlike monthly – basis.

The benefits of a JBSP home loan

From inside the p obligations surcharge for all of us to invest in next residential property andbuy-to-assist features are produced. So it placed a life threatening obstacle in the form of parents finding in order to individually let the youngster log in to for the property steps.

An element of the destination regarding good JBSP mortgage is the fact mothers try maybe not titled to the identity deeds thus won’t need to pay this new stamp duty surcharge, which can set you back a lot of money.

Brokers state enquiries have also enhanced since the stamp duty are abolished having very first-big date buyers to order land listed up to ?3 hundred,000.

Once again, taking right out a fundamental shared financial means consumers perform miss on that it income tax cut because they wouldn’t be buying the possessions by themselves.

JBSP mortgages: exactly how value was examined

A perfect intent behind this type of financial is the fact that the youngster becomes to be able to pay the financial for the their.

This is why lenders are far more gonna agree an enthusiastic software if the child can show that they are planning to provides significant wage development in the newest after that years as their industry moves on.

One downside, not, is that old mothers you will be unable to become approved given that loan providers often simply give mortgage loans that run so you’re able to 70 or 75 yrs . personal loans in Columbus TX old.

Using this type of style of offer, moms and dads may find it tough to enjoys the brands taken from the borrowed funds contract in the event that interactions bad.

Which also offers JBSP mortgages?

When you are mortgage brokers is seeing an increase in just how many enquiries from the JBSP mortgage loans, they truly are nonetheless never available along side industry.

Of large users, simply Barclays, Town Lender andClydesdale and you may Yorkshire provide this type of purchases (doing ninety% loan-to-value), even though mortgages are available compliment of individuals building communities – as well as Sector Harborough, Furness, and you can Hinckley & Rugby.

If you’re considering this kind of financial, it is best when planning on taking pointers out of a large financial company, due to the fact less building communities which provide a far more individual ‘case-by-case’ underwriting processes are a great deal more responsive to software.

Interest in JBSP mortgages

At this stage, it’s difficult to say just how prominent JBSP mortgages get, or indeed just how they truly are attending advances in future, just like the British Funds does not gather data of this type.

There are cues you to definitely loan providers are starting when deciding to take JBSP selling more absolutely, regardless if, that have Family unit members Building Society launching an alternate home loan later last year after enhanced request out of agents.

Predicated on Family Strengthening Society’s leader Draw Bogard, 1 / 2 of apps try refused considering the applicant not having a position that would make adequate income over the years, or the decreased an adequately direct loved ones commitment within applicants.

Just like any professional financial affairs, you need to look around: if you find yourself there isn’t extreme competition between lenders you may be in a position to obtain most readily useful rates into a different sort of contract.

You’ll find a range of alternative methods you could potentially let your child get its very first family, with our selection being among the most prominent:

- Guarantor mortgages:specialist guarantor mortgage loans enables you to make use of discounts so you can safe your baby’s financing, to your Family unit members Springboard mortgage given by Barclays among the most well-identified. Lenders will demand one lock your own deals right up having an excellent set several months, that could mean lacking the best discounts rates elsewhere.

- Using your domestic since the safeguards:some loan providers promote marketing where you could play with equity on your home since security for the newborns mortgage – but be cautious, since your house and additionally theirs could well be on the line once they default.

- To order a home together:as stated prior to, you could remove a timeless joint mortgage, which can help you keep control of your money. You are going to, however, feel economically related to your son or daughter, and you you may face a big stamp duty expenses.

- Enabling these with their deposit: when individuals think of the ‘bank of mum and you can dad’, sometimes they remember moms and dads gifting otherwise credit currency on their youngsters to help them which have a deposit. When you are providing a longer-label means, you could envision guaranteeing she or he to start a lifetime Isa during the chronilogical age of 18, which you yourself can up coming subscribe to. Places on the such account can also be gain a twenty-five% bonus whether your youngster pertains to buy property.