While you are to purchase a property, refinancing mortgage, or maybe just keeping an eye on their handbag, knowing the Federal Reserve’s interest choices is essential. Such prices apply to sets from borrowing prices for automobiles and you will land on the returns you notice in your savings profile. So, in which is actually rates of interest lead along the 2nd 2 yrs? Strip right up, since we have been about to plunge into the!

Remember that recent stretch whenever what you appeared to cost more during the the latest supermarket? That is rising cost of living, and it is started a major matter towards Given. Their number 1 efforts are to save rising prices in balance, ideally to a target rates away from 2%.

In 2023, inflation hit a very hot 8.5%, the highest level inside the over forty years. Which brought about a life threatening stress on household costs, since the relaxed essentials such groceries, gasoline, and you can book all of the saw sharp price expands.

The interest rate Hike Rollercoaster

Into the a historical move to combat rising prices, the new Fed embarked towards a few aggressive price hikes during 2022 and you may 2023. Which designated a life threatening shift on the reasonable-interest-speed environment that had been successful for more than a financial crisis.

The latest federal loans rates, which is the benchmark interest rate you to definitely banks charges both for straight away financing, flower of near no to help you the latest height, the best this has been given that early 2000s.

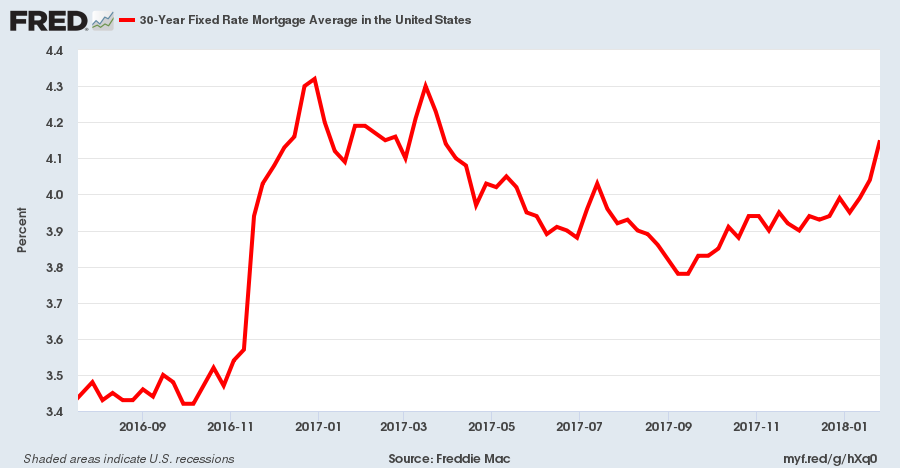

This got an obvious impact on borrowing from the bank will set you back across-the-board. For instance, home loan pricing leaped, putting a damper on the housing marketplace due to the fact potential housebuyers encountered large monthly premiums.

A move for the Means

Previous monetary data, instance moderating rates develops and you may a somewhat shorter hot occupations field, implies rising cost of living might be starting to ease. It’s led brand new Fed so you’re able to signal a modification of way. They might be today provided decreasing prices on the latter half paydayloanalabama.com/union 2024.

Its projections, in depth within latest Article on Economic Forecasts (SEP), let you know a possible loss of 0.75% in 2010, with the exact same cuts probably proceeded when you look at the 2025.

Yet not, the brand new Given has also emphasized that particular quantity of desire costs in 2 years regarding now is unclear. It will confidence the way the discount functions on the coming days and age.

In the event that rising prices remains stubbornly higher, this new Given may prefer to remain pricing large for over currently envisioned. In contrast, in the event your discount weakens significantly, they could cut rates significantly more aggressively.

The fresh Fed’s projections give certain clues regarding the you can miss inside the rates, but there’s no protected lead. This is what we know:

- Basic Interest Cut-in 2024: Since , the brand new Federal Set-aside has elected in order to slash the fresh new government finance target rate by the 0.50 commission issues, . is on a-two-decade high, around 5.3%.

- Newest Rates: That it choice reduces the brand new borrowing will set you back away from a beneficial 23-year higher, dropping off a variety of 5.25%-5.50% to help you 4.75%-5%.

- Fed’s Projection: Its questioned that the Fed often lower interest levels in order to a variety of 4.25%-cuatro.50% by the end from 2024, over it anticipated inside the Summer, once the rising cost of living steps the dos% objective and jobless goes up.

- Gradual Decline: So it tips at a gradual with the same reductions.

- Uncertainty Reigns: But not, the newest Fed emphasizes both-year timeframe is stuffed with unknowns. The particular speed within the 2026 is based greatly on upcoming monetary study.

- Inflation’s Trajectory: When the inflation enjoys dropping into Fed’s dos% target, it paves just how for lots more aggressive rate decreases.

- Monetary Efficiency: Conversely, in case the economy weakens significantly, the fresh Provided you will reduce cost so much more steeply to cease a recession.

While a great 0.75% visit seasons-end appears probably, the complete drop-off more 24 months is ranging from one and you may a more substantial slashed. Staying informed throughout the after that monetary studies together with Fed’s pronouncements have a tendency to make it easier to see the actual trajectory of interest rates.

How the Fed Has actually Over the years Tackled High Inflation?

In earlier times, the fresh new Given has had an identical method of treat highest rising cost of living: raising interest levels. It acts such as a tool to help you faucet the brand new brake system towards economy. The following is a closer look:

Air conditioning Consult: Whenever inflation surges, they have a tendency to implies an enthusiastic overheating economy. Anybody and you will businesses are purchasing more income than usual, driving rates up. By raising rates, the brand new Given renders borrowing higher priced. That it discourages a lot of shelling out for things such as domiciles, automobiles, and you will team financial investments.

New Bubble Feeling: Higher borrowing costs do not just apply to larger requests. Nevertheless they impact things such as bank card interest rates and you may loan terminology. This can direct visitors to be much more careful of their spending, and this eventually reduces full demand throughout the market.

Perhaps one of the most dramatic instances of the Fed having fun with appeal cost to battle rising cost of living occurred in this new eighties. In the past, rising cost of living skyrocketed in order to nearly 15%, resulting in extreme economic difficulty. The fresh Provided, provided of the president Paul Volcker, grabbed aggressive action. It implemented some good-sized interest rate hikes, driving brand new federal money rate alongside 20%.

The new Bland Lose: Such highest costs had been hard treatments towards benefit. It triggered a depression during the early eighties, leading to large jobless. not, the strategy worked. Rising prices is actually produced manageable, paving the way in which getting a period of secure monetary growth in the later part of the several years.

Sensation of the fresh new mid-eighties highlights the trade-from involved in using rates of interest to battle inflation. While it is productive, additionally impede economic hobby in the short term. The fresh new Fed aims to find the proper balance taming inflation without causing an excessive amount of economic serious pain.

It is vital to remember that per economy is different. The latest Given considers certain points past simply rising prices pricing when creating interest decisions. Nonetheless they take a look at facts such jobless and you may economic gains so you can make certain its actions try not to create unintended outcomes.

What this implies to you?

Credit Can cost you: In the event your Given comes after done with rates cuts, credit getting things such as properties and you can cars becomes less expensive next year or two. This might be a very good time to look at home financing refinance or snag a package on a different auto.

Discounts Levels: Whenever you are rising pricing have been great news having savers, potential price incisions you’ll mean down production on savings accounts. not, it is very important keep in mind that even after quite straight down prices, their offers might nevertheless develop over time.

Remember, It is not Place in Stone. The latest savings was an elaborate beast, and Fed’s behavior can change according to inbound studies. Unanticipated economic occurrences otherwise persistent rising prices can cause these to adjust its agreements.

The brand new Takeaway: Next two years often see high alterations in interest levels. Keeping yourself told about the Fed’s behavior helps you create wise monetary selection, whether you are buying a house, planning advancing years, or seeking to extend your dollar next.