- What if among the many co-consumers cannot make home loan repayments? In the event the work losses, disability or any other situations generate one of several individuals not able to match costs, just how have a tendency to the remainder activities deal? Do you ever provides a provision to find out the most other group? To market its share to some other? (Deleting an excellent co-debtor throughout the financing you can expect to want refinancing, an arrangement that will mean large money.)

- Can you imagine some co-consumers want to promote the property but someone else do not? In the event the one or two people get an excellent duplex, as an example, and one of your five co-individuals becomes work all over the country, how have a tendency to one to end up being managed? Need certainly to the property feel marketed? Normally the couple staying to your get from someone else? Can also be the newest vacated assets become hired out to safety the mortgage payments? Therefore, who collects the new rent and you will pays for repairs of your tool?

- Can you imagine a good co-borrower passes away? If for example the inactive person’s display of the property visits an heir, carry out the almost every other co-individuals have the choice (otherwise obligation) to buy aside the late lover’s display? Is to co-borrowers take-out life insurance policies using one a different sort of to cover the particular shares of your property’s cost?

Trying to get home financing that have several applicants is essentially the same for every single applicant because if that they had taken out financing to your their own: The financial institution tend to generally speaking want for each and every applicant to incorporate:

- Consent to perform a credit check, together with overview of credit reports in the one or more of your national credit reporting agencies (Experian, TransUnion or Equifax) and you will formula of fico scores according to research by the belongings in one or more of these profile. Loan providers place their own cutoffs to own minimum appropriate fico scores, but Federal national mortgage association and you may Freddie Mac computer both require all of the candidates in order to keeps a FICO Rating of at least 620 so you can be eligible for compliant fund.

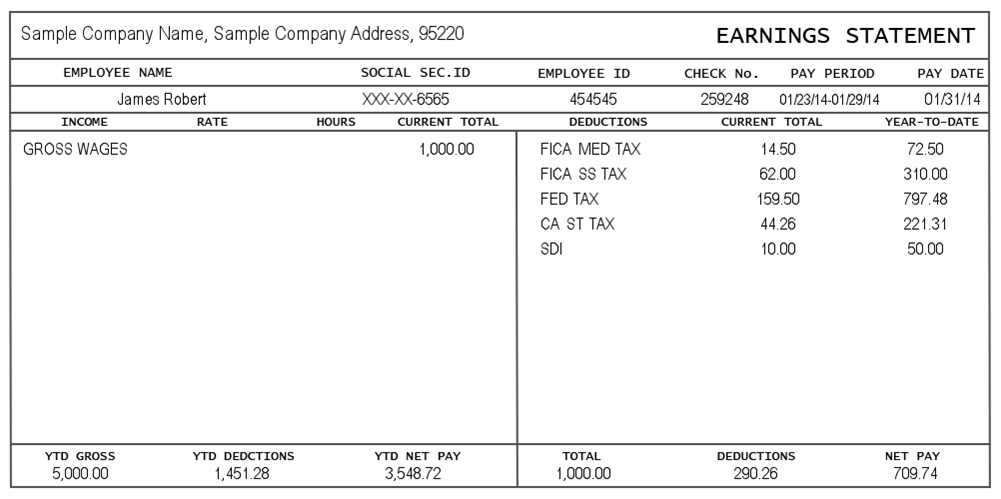

- Proof money in the way of spend stubs, tax returns otherwise financial records highlighting head dumps. Lenders generally speaking dont lay minimum income criteria, but they’ll want to see you have a reputable source of cash, and that you secure enough to safeguards the loan costs.

- Evidence of monthly debt obligations, having purposes of calculating a personal debt-to-money ratio (DTI). DTI, the percentage of your own monthly pretax income predicated on loans money (like the anticipated level of the mortgage payment), is used as a measure of the available income and you can element to cover the loan. Lenders disagree within their requirements. Federal national https://paydayloanalabama.com/smiths-station/ mortgage association and Freddie Mac computer place a standard restrict DTI regarding 36%, however, support DTIs as high as 45% so you can consumers which have good fico scores whom fulfill most other qualifications conditions.

Just how Try an effective Co-Borrower Not the same as good Cosigner?

The latest difference between good co-debtor and an excellent cosigner is that a good co-borrower offers obligation with the real estate loan and you can offers control in the the house are funded, if you find yourself a good cosigner offers obligations on mortgage it is perhaps not titled into the action or term towards the assets and that does not show ownership.

Which huge difference is actually away from shallow, but about view of a mortgage lender, cosigners and you may co-consumers are the same: Since financing individuals, are typical subjected to a comparable analysis techniques and you will, whether your financing is approved, are common equally guilty of to make costs in regards to the mortgage arrangement. If the repayments fall behind, the financial institution has actually court recourse commit immediately after any otherwise all co-applicants to recoup bad debts all of them less than regards to the borrowed funds.

The bottom line

Teaming with other people to have a shared mortgage app will help your be eligible for money within the deeper amounts otherwise which have best credit terminology than you may get for those who applied on your. However the consequences out of entering into a home loan package that have multiple borrowers is going to be difficult, and it’s really best if you consider them compliment of meticulously ahead of moving on. Anytime you’re considering trying to get home financing, it seems sensible to evaluate your credit report and you may credit rating well in advance, to completely clean up one incorrect records in the statement and you can, if required, for taking procedures to help you liven up your credit rating.