How frequently maybe you’ve seen an episode of Brand new Cut off otherwise Grand Designs and you will heard of price of building another type of possessions strike of funds? Information and labour can easily be higher priced than just first think, the elements you certainly will halt build, and depending on what’s going on globally, certain product is in short supply.

You may be capable of getting a predetermined offer from the designers which means you shell out a predetermined amount of money to have construction, but there are still most other costs which are often added to your. Additionally, you will have to deal with council strengthening it permits, prices, and other expenses.

While strengthening a residential property in a recently based city, you will find a chance one nearby advancements you will definitely negatively effect your property’s worthy of. A big apartment building you will block your property’s have a look at. Otherwise this new neighbours you will definitely begin defaulting to their mortgage loans.

Excessively likewise have in your neighborhood (a great amount of the new households) may also reduce the property value your home since rates appears as inversely regarding also provide. None associated with the was protected, but it’s really worth considering.

No local rental earnings until the structure is fully gone

House bring a little while to obtain based-a couple months so you can a year. This really is for hours on end you will be making mortgage money versus earning accommodations earnings when you if not might possibly be should your family currently stayed.

The right mortgage to suit your investment property

If you have felt like facing building a residential property, a basic investment mortgage you will definitely serve. So it loan assists fund the acquisition out-of a residential property; it really works for example a frequent home loan.

For those who perform need certainly to build, you can get a houses loan to own investment property. A houses financing is a loan which have an initial-identity construction months used to fund the expense of strengthening good the brand new assets. This loan usually persists till the design of the property is done. In the event that financing identity are upwards, your convert to a consistent mortgage device put of the bank.

You will be able to utilize a basic financial to have building a different sort of house if you have sufficient equity into the an current possessions to begin with build, but that it constantly relates to an extremely higher amount of cash.

Whatever you decide, will be here to help. Talk to our amicable financing experts concerning your investment financing demands. Otherwise pertain on the internet and boost your property financial support trip!

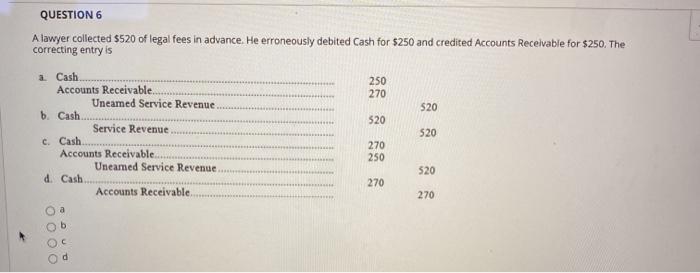

The basics of pay day loans in Brent build funds to have property capital

Framework fund fund the construction procedure, in the put so you’re able to simple conclusion. Repayments into the a property mortgage is actually attention-simply, prior to reverting so you can dominant-and-desire up on conclusion, except if or even agreed.

In lieu of a mortgage, framework money protection the expense your sustain while they exist. From the , i follow a half a dozen-phase techniques that has:

- Deposit The amount repaid into the builder having framework to start.

- Foot The concrete slab might have been lay out otherwise footings and you may foot brickwork was accomplished.

- Physique Our home figure could have been based and you may approved by the inspector.

- Lockup New window, gates, roofing, brickwork, and you may insulation had been installed.

- Restoring This new plumbing, electronic and you can temperatures possibilities, kitchen cabinetry, accessories, tiling, and the like was strung.

- Practicalcompletion The latest fencing, web site brush-upwards, and you may final payment into creator.

This type of amounts can be also known as improvements payments’. Possible simply be billed appeal according to research by the amount which you have fun with per progress percentage.

If you have been approved having a beneficial $five hundred,000 design mortgage, but one to first ‘base’ phase can cost you $100,000, the financial institution is only going to charge you attract on that $100,000, through to the next advances fee happens.