To find a house for the first time should be challenging, particularly in an area as big as the new Dallas-Fort Worth metroplex. The good news is, several basic-date homebuyer software in the Dallas, Colorado, can help you browse the method. Such apps provide financial help and you may advantageous mortgage terms and conditions, and make homeownership even more available getting earliest-big date people. Skills this type of choices is very important to locating the support you prefer. Listed below are half a dozen software so you can on your way to owning a home into the Dallas.

As of , attempting to sell a home from inside the Dallas, Tx, requires on average 50 months. Yet not, a residential property information is usually changing. Get in touch with Norma Wall structure having let buying and selling house within the Dallas, Texas.

Dallas Homebuyer Advice Program (DHAP)

This new Dallas Homebuyer Direction System (DHAP) aims to assist homeowners which have lower to help you moderate money. It’s as much as $60,000 for property inside Highest Opportunity Elements or over in order to $fifty,000 to many other parts. So it help is an additional lien on your property as opposed to appeal otherwise monthly obligations. But when you sell, rent, or transfer the home till the loan label stops, you’ll have to repay it. Addititionally there is a targeted Jobs Homebuyer Advice Program within this DHAP for specific procedures eg coaches and medical learn this here now care experts.

TDHCA My personal Very first Texas Family

The brand new TDHCA My personal Basic Texas Household program was targeted at very first-go out customers into the Texas. It has got a thirty-year fixed-rates home loan with lower than-industry rates of interest or over in order to 5% inside deposit assistance. So it assistance is an effective deferred loan without attention, and therefore you can easily repay it only if you offer, re-finance, or totally repay the mortgage. The program is also accessible to pros and people who haven’t had property within the last 3 years.

TDHCA My Options Texas Family

The TDHCA My personal Possibilities Texas Domestic program also offers so much more independence. Its open to one another basic-time and repeat homeowners. For instance the My Earliest Colorado House program, it provides a 30-season repaired-rates home loan and up so you can 5% in downpayment assistance. In addition boasts options for antique finance by way of Fannie mae.

TSAHC House Nice Tx Home loan System

The newest TSAHC Home Sweet Colorado Home loan System even offers a thirty-year fixed-rate mortgage or over to help you 5% during the deposit advice, and that’s received as an offer and you can does not need to feel reduced, otherwise just like the a forgivable 2nd mortgage. You must pay off the assistance for those who promote otherwise refinance inside three years. This program was available to all of the consumers. Depending on your local area, it will take a credit rating of at least 620 and has now income and buy price limits. Dallas County’s cost restrictions try $110,three hundred to have non-focused portion and $577, getting directed parts.

TSAHC Homes having Texas Heroes Program

The brand new TSAHC Residential property to have Texas Heroes Program is actually for community solution gurus eg teachers, firefighters, cops, EMS employees, and you can pros. It’s the same experts since the Home Sweet Texas Home Mortgage System: a 30-12 months repaired-rates mortgage and up so you’re able to 5% for the down-payment assistance, which can be a grant or a great forgivable second financial.

Other Very first-Day Homebuyer Loan Apps

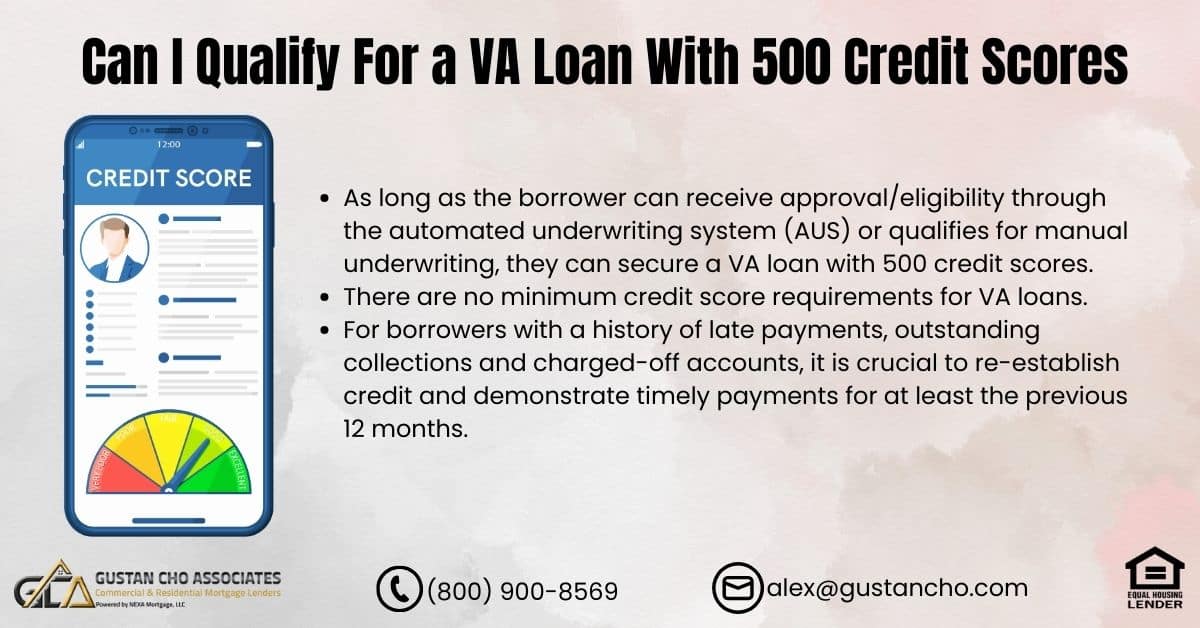

Along with these types of local applications, searching towards the federal alternatives such as FHA, Virtual assistant, and you will USDA money. This type of apps cater to individuals means, regarding straight down credit scores in order to army provider, taking flexible a way to money your first home.

The conclusion

Dallas now offers of numerous applications to help very first-time homebuyers. If or not you need help with an advance payment, a lower life expectancy-notice mortgage, or something like that particular towards employment, such apps helps make owning a home during the Dallas significantly more possible.

Speak to your a property pro! Contact Norma Wall structure, Representative in the Northern Area Realty, during the 214-212-6770, or visit our very own web site to satisfy we regarding educated agencies. Why don’t we mention the options to each other and watch how exactly we produces a change which works for you. Since your Real estate professional, the audience is right here to help you place realistic standards and make suggestions each step of way.