step 3. Restoration and you will Reputation: Having tangible assets particularly car, equipment, or home, the condition and you will fix of one’s collateral amount. A proper-handled asset could demand a top well worth.

cuatro. Judge Encumbrances: Collateral’s well worth shall be influenced by legal encumbrances, instance liens or delinquent taxes. Its essential to make sure the security is free of charge of every legal challenge that might get rid of its value. For example, a house having an income tax lien possess a diminished appraised really worth.

These types of membership serve as excellent equity alternatives, while they provide an amount of exchangeability when you are encouraging the lending company cost

5. Depreciation and you can Admiration: Some types of guarantee, such as automobile, tend to depreciate throughout the years, although some, instance particular artworks, you will take pleasure in during the value. knowing the fashion on the market about your own collateral is also help you make advised decisions. Such as, whenever you are using a car while the equity, think that it manages to lose really worth throughout the years, so you may must bring extra equity otherwise build huge costs.

six. Documents and you may Provenance: When speaing frankly about highest-well worth property such as for instance ways, antiques, otherwise collectibles, that have correct paperwork and you can provenance can also be rather enhance their well worth. Paperwork also provide proof of authenticity and historical benefit, possibly improving the collateral’s really worth. That is particularly important about artwork globe, where provenance produces a hefty difference in the cost of a visual.

seven. Use of Collateral inside Several Money: In some instances, borrowers age collateral to help you safe numerous fund. This routine would be high-risk and really should getting approached that have caution. Lenders constantly set liens towards collateral, it is therefore difficult to use the exact same resource to other loans up until the first loan is actually totally paid back. Knowledge this type of limitations is paramount to avoid legal issue.

Evaluating the worth of guarantee was a good multifaceted process that happens beyond a straightforward comparison of an enthusiastic product’s market price. It involves given affairs particularly appraised well worth, volatility, standing, courtroom encumbrances, depreciation/love trend, papers, and possible limitations towards the collateral use. Since borrowers, an extensive understanding of these types of aspects is very important to make advised behavior and you may making certain brand new successful and you may responsible accessibility finalized-avoid borrowing from the bank guarantee.

5. Common Possessions Used given that Collateral

In the world of funds and you can credit, collateral performs a pivotal part inside protecting money, mitigating dangers, and bringing a safety net for consumers and lenders. Equity basically involves putting up possessions useful due to the fact a hope towards cost from a loan. Inside our exploration of signed-stop borrowing collateral, it’s crucial to explore the many possessions that people usually use to safe the economic upcoming.

Home stays probably one of the most popular types of equity. Homes, property, and you can commercial services act as real and you can worthwhile possessions you to definitely borrowers promote because the security to own finance. In the event of default, the lender can also be seize the house and sell they to recuperate their money. That it besides will bring safeguards to own lenders but can plus impact when you look at the positive conditions to have borrowers considering the down associated dangers.

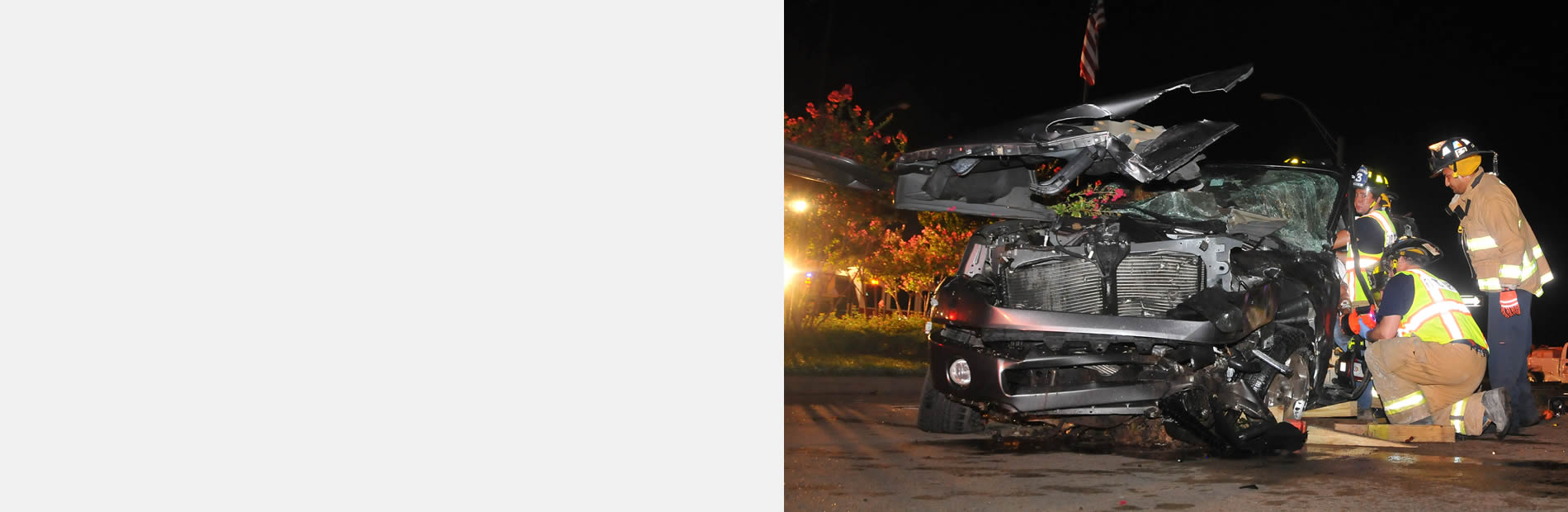

A separate prominent form of collateral is vehicles, such as for example trucks and motorbikes. These types of movable possessions can be used to safer automobile financing. Loan providers routinely have a beneficial lien to the automobile’s identity, and therefore provides all of them the installment loan company Central UT legal right to repossess the auto in the event the borrower doesn’t build repayments. It’s an useful way for individuals supply loans for purchasing auto in the place of requiring a pristine credit score.

When anyone don’t possess concrete property giving due to the fact guarantee, they are able to check out their deals account or certificates from deposit (CDs). Borrowers you’ll discovered much more advantageous interest rates considering the lower risk involved in having fun with cash-situated guarantee.